To manage a bank, you need to understand the combined impact of loans, with the aim of developing a distribution function for possible losses on your lending portfolio. Unfortunately, you cannot assume that loans follow normal distribution patterns. Based on empirical evidence, a loan is much more likely to be downrated than uprated. What’s more, in the event of a default, the potential loss is much greater than the potential gains from improved credit quality.

Expected losses relate to average defaults. In credit ratings, they are often described as standard risk cost. But this is misleading. Expected losses are merely costs, because if the rating is correct over longer periods of time, these losses will occur (i.e. these costs will be incurred) in any case. Unanticipated losses – that is, above-average losses in a particular year – are what represent the actual risk.

In such situations, a bank’s equity capital must be sufficient to cover these losses. This cover is referred to as economic equity capital, as opposed to regulatory capital. The amount required depends on the bank’s target rating. If, for example, a bank aspires to an AA rating, the bank’s probability of default in any given year should not exceed 0.02%, meaning that losses up to this level should be equity-backed or externalised. The equity required should then be stated in valuations at the appropriate target return. As a rule, marginal equity – meaning any increase in economic capital as a consequence of accepting further loans – is allocated to these loans.

Portfolio management involves paying attention to, on the one hand, risk distribution as reflected in credit ratings; this determines the expected losses. But on the other hand, it is just as important to analyse diversification within the portfolio. The lower the correlation between loans, the lower the probability that an unexpected major loss will occur. Consequently, for the same level of expected losses, a granular portfolio ties up significantly less equity capital than a portfolio that features risk concentrations.

Managing loan portfolios is all about managing unexpected losses. As well as ratings, the extent of such losses is hugely dependent on diversification. These portfolio considerations influence the prices of new loans, based on the cost of equity.

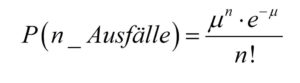

So if we use the following parameters:

µ Total probability of default of all loans of the same magnitude

n Number of loans of the same magnitude (where the Lost Given Default is the same)

e Euler’s number

we calculate a probability of exactly n defaults.

One way for banks to reduce their equity risk is to sell loans. The most sensible method is to sell the receivables via asset-backed securities. These represent attractive investment opportunities for investors, because it is easier to spread risk concentrations. Meanwhile, the bank exchanges equity risk for borrowing costs, resulting in a significantly higher return on equity.

Frankfurt School offers a broad portfolio of seminars and certification courses on risk management.