by Altan Pazarbasi (Frankfurt School), Paul Schneider (University of Lugano and Swiss Finance Institute) and Grigory Vilkov (Frankfurt School).

Bottom line: while recovering expectations about the future market conditions from the option prices, it is important to take into account the sentiment towards the market (bullish, bearish, neutral). It is also important to use not only market options, but also options on the future market volatility (VIX futures options). Having extracted forward-looking physical and risk-neutral distributions from options, one can create an optimal (Sharpe ratio maximizing) trading strategy using any set of tradable instruments. We use SP500 index and VIX futures, and show that an aggregate agent created from agents with different sentiments successfully adapts the best strategy across different economic regimes, achieving a very low drawdown and a decent Sharpe ratio (>1.10 p.a.) over the period from 03/2006 until 12/2017, with monthly rebalancing.

Financial markets are constantly evolving, providing investors with more efficient ways to trade, with instruments spanning more states of nature, making markets more complete. For example, in the last decade, instruments giving direct access to volatility, such as VIX futures, have shown an enormous gain in popularity. On February 1, 2019, the Volatility Index (VX) Futures accounted for more than 99\% of the total volume and about 99\% of the open interest on CBOE Futures Exchange.

Markets aggregate information, and academic research routinely uses observable asset prices (e.g., of options) to make inferences about subjective expectations of agents trading in the markets. To accomplish this feat, one makes specific assumptions about true prices of assets (as opposed to observed bid-ask spreads or non-traded strikes), investor preferences (to derive the intertemporal marginal rate of substitution), underlying processes, and the correspondence between traded assets and economic (consumption) states. Interestingly, while the market index and its expected volatility represent two major dimensions describing states of nature for economic agents, the information from volatility markets has largely been neglected in studies working on recovery. How important are the volatility states in the agents’ beliefs and how does the existence of volatility instruments affect the perception of risks and risk-return trade-off? How different can be agents’ beliefs, subjective pricing kernels, and the resultant optimal strategies so that they are compatible with observed market prices? Is disagreement among agents linked to expected economic states? We study these and a number of related questions on recovering market-compatible beliefs.

We acknowledge that it is not possible to recover a subjective distribution from asset prices without making assumptions, but rather than relying on specifications or properties of the underlying processes, we choose to impose economic beliefs instead. Different from the inherent literature, we allow also the pricing distribution to depend on these beliefs, nevertheless staying consistent with all quotes observed in the market. Market incompleteness induced by bid ask spreads and discretely quoted option strikes provides much flexibility in the dimension of beliefs, and a wide range of heterogeneity may coexist with the recovered distributions of an “assumed” aggregate agent. We come to such conclusions from the following steps: first, we devise an algorithm to extract a risk-neutral and a corresponding objective joint distribution of the market index and its future volatility consistent with particular sentiment towards the future market performance and volatility dynamics from the quotes of traded options. This algorithm is consistent with bid ask spreads from all observed instruments, and recovers these distributions under economic constraints. The title ‘sentimental recovery’ stems from the particular assumptions we make about the sentiment of the agents, while the procedure is otherwise model-free. We choose the bivariate index return and index volatility distribution, because a liquid option market exists, and because it is shown in Chabi-Yo, Garcia, and Renault (2008) that it may contain economically relevant information that is not contained in the respective marginal distributions. Second, we put our algorithm to work using S&P 500 and VIX option quotes to extract risk-neutral and subjective objective measures with implicit beliefs from extremely bullish to extremely bearish. Adding the second (volatility) dimension to the recovered subjective (physical) distributions plays a crucial role in how agents treat “good” and “bad” states: in the presence of the second dimension, the Arrow-Debreu prices change considerably stronger across volatility states than across market index states, and overall the joint state space of market and volatility regularizes the recovery procedure. Depending on subjective beliefs, agents pursue very different optimal trading strategies, and the consideration of the two-dimensional distribution overall leads to more balanced investments. Lastly, we show empirically that dispersion of beliefs about future market performance and its volatility are linked to future investment opportunities. In particular, we highlight that the dispersion of beliefs about expected volatility, which is pivotal in forming heterogeneous pricing kernels, predicts the future state of the real economy.

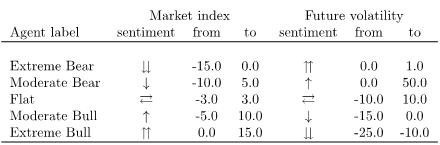

In short, we assume that each agent in the economy has some sentiment towards market and its volatility, say, in one month. For example, I believe that market in one month will grow between 1% and 3%, and the volatility futures will settle from -10% to 0% from their current levels. It defines an agent, and we use (just for the sake of having several agents) the traders with beliefs as follows:

Then we solve a complex optimization problem, where each agent’s beliefs under P and Q measures are fitted to SP500 and VIX options under a number of constraints described in the paper. As a result we have probability distributions for each agent, and we can analyze the difference in beliefs, optimal trading strategies of each agent, and the relationship between current difference in beliefs and the economic conditions.

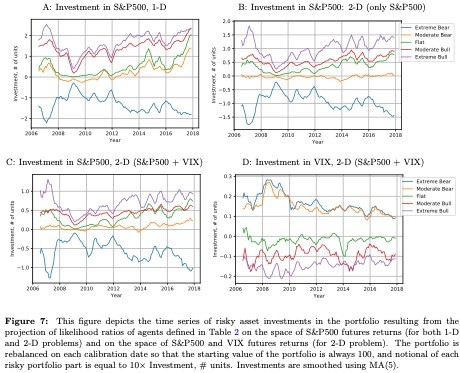

For example, we look at the portfolio strategies of our agents below:

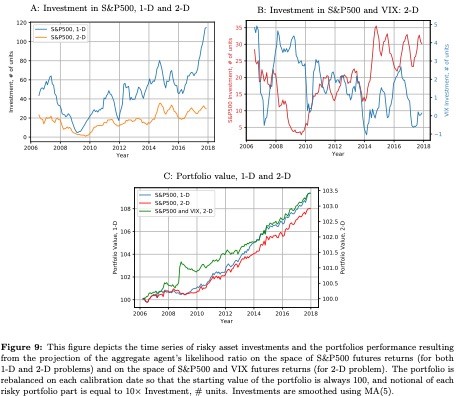

Observe that agents pursue quite different strategies being long or short the market most of the time. They also have very different investments in the VIX futures, betting on volatility markets. When we aggregate the agents into an “aggregate” one, we see that it basically performs as the “most lucky” out of the five agents we are mixing into it:

and the performance of quite good even in bad times for the market! Basically, in 2008-2010 the aggregate agent correctly goes long volatility, which in other times burns quote a long of money on long positions.

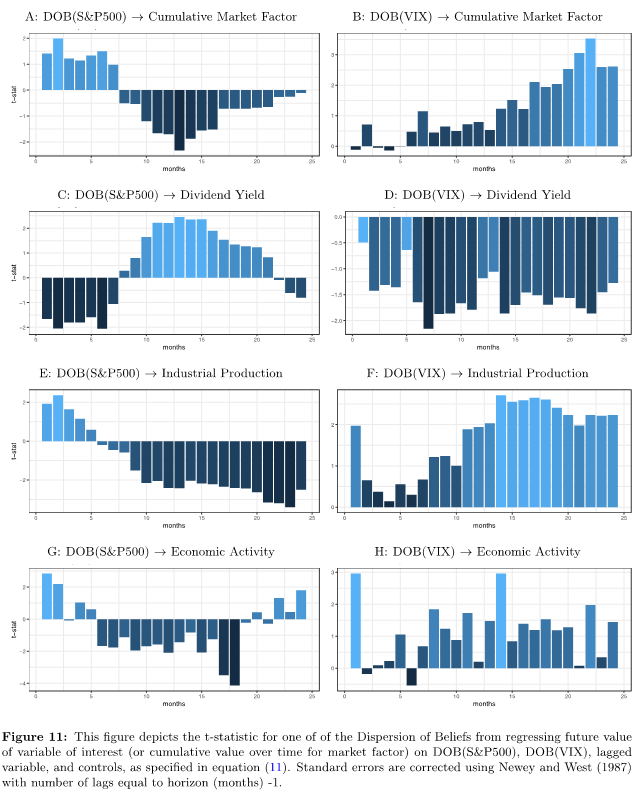

When we define the dispersion of beliefs of our agents, we observe that they are related to current and future economic conditions. We observe that DOB(S&P500) works at intermediate horizon, while DOB(VIX) effect is rather long-run. A high level of dispersion of beliefs regarding market negatively predicts market returns at around annual horizon, and positively (due to lower market valuation) – dividend yield. DOB(VIX) has no short-term predictability for the market, but predicts it positively for the long horizons (18 months and beyond). Market DOB negatively predicts industrial production (mostly beyond one year horizon) and economic activity (six to 17 months) with borderline significance. DOB(VIX), positively predicts industrial production for longer horizons and has mostly insignificant (though positive) relation to economic activity. Thus, even though contemporaneously both DOB variables are positively correlated, they possess quite distinct relation to the future economy: DOB(S&P500) has medium-term negative predictability, while DOB(VIX) shows longer-term positive predictability.

At the moment we are working on enhancing our study, and any comments will be greatly appreciated!

Download and read the full paper (you will not regret it!)