Undoubtedly, the COVID-19 pandemic altered many aspects of our daily life, drastically reshaping how we work and live. As a matter of fact, the pandemic was a disastrous occurrence as it left many organisations with no clue of how to move on.

However, it is equally important to note that COVID-19 has shifted financial systems worldwide to a far higher level of digitalisation. The Coronavirus pandemic has amplified the significance of access to digital financial services due to its role in promoting economic recovery and stability.

For instance, the pandemic made governments provide financial assistance for their respective citizens through digital methods such as mobile money, crowdfunding, and more. People were driven to discover alternatives to cash and face-to-face commerce due to social distancing. The agenda of digitisation of financial services is particularly salient in emerging markets.

Owing to the pandemic, several governments have made the digital economy a priority in order to boost innovation and financial inclusion. As a result, the rate of digital transformation, notably in the financial sector, has accelerated to unprecedented levels. Many governments encouraged the implementation of digital payment systems and the greater use of bank accounts in order to enhance speedy and efficient money transfers to those in need, as well as to foster the continuation of economic activity during lockdowns.

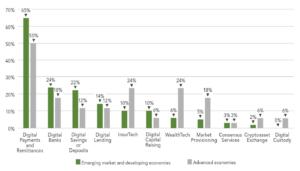

The Global FinTech Regulatory Rapid Assessment Study depicts a significant surge in the use or offering of numerous FinTech products and services since the wake of the pandemic, including in some emerging markets. For example, the graph below shows that respondents in developing economies report an increase in the use of digital payments and remittances (65% vs 50% in advanced economies), digital banks (24% vs 18%), digital savings or deposits (22% vs 12%), and digital lending (14% vs 12%).

Image source: Global FinTech Regulatory Rapid Assessment Study

However, we must also realise that as COVID-19 fueled digital transformation in the finance sector, the increasing digital divide equally creates new inequality problems. For instance, many governments, particularly those in developing countries with underdeveloped capital markets, continue to face major funding deficits for the development of digital infrastructures. Thus, bridging the gaps and facilitating safe, reliable, and inexpensive digital infrastructures are also essential for digital financial inclusion.

Clearly, the pandemic has had severe economic impacts, particularly on vulnerable and low-income populations and informal workers in emerging markets. Innovative strategies toward inclusive finance are required to improve livelihoods and boost resilience among the underserved population. A number of actors and regulatory frameworks should be supported:

Microfinance providers have invariably played a key role in providing access to financial services to those at the bottom of the economic pyramid, such as micro, small, and medium-sized businesses. Microfinance providers can leverage their influence and trust with customers to use digital technologies in ways that deliver the benefits of the digital economy to customers.

When solving financial inclusion deficiencies, priorities should be placed on expanding the use of digital social payments comparable to PayPal or Google Pay but designed to the needs of under-served customers. Adopting digital payment methods, digital identity, and effective data acquisition and usage is important for an equitable economic recovery.

COVID-19 has already highlighted the need for technological innovation in order to achieve financial inclusion. However, governments have a significant role to play by including digital innovation in the finance industry in their plans and creating a regulatory environment that supports safe digital innovation.

With more than $2 billion in daily transactions, mobile money has become a new regular habit for millions of people all over the globe. Compared to other digital financial services, mobile money providers have two distinct advantages: exceptional understanding of the local market and strong alliances and cooperation with fintechs, banks, governments, and other key players in the digital finance ecosystem. Therefore, harnessing the benefits of mobile money can help weather financial storms and help local economies become more resilient.

In an era where technology is continually expanding and transforming the economy, it can be difficult for a single company to pool its resources and accomplish tremendous outcomes on its own. Consequently, financial services providers (FSPs) such as banks, mobile network operators (MNOs), and microfinance institutions (MFIs) should collaborate to create and test innovative business models for financial inclusion. They can expand their reach, overcome regulatory obstacles, gain access to funding and resources, and enjoy a variety of other advantages. Ultimately, the spread and advancement of digital financial services can be facilitated by effective collaboration within the financial services industry. Consumer rights and basic principles of competition policy will still need to be safeguarded.

COVID-19 caused serious economic shocks across the globe. It affected people’s means of livelihood and brought drastic changes to the global economy. Digitisation is now central to achieving financial inclusion. Financial services firms will need to upskill to safely use such services and new technologies, which are evolving rapidly. Frankfurt School’s Summer Academy and also the revised online course Certified Expert in Digital Finance are excellent opportunities to do so. In order to recover from the impact of the pandemic, we must take advantage of the opportunities it created and build a more resilient financial system for everyone.