Climate risk is reshaping credit risk, turning floods, heatwaves, and policy shifts into balance-sheet issues. This post explores how financial institutions can use loan portfolio mapping and hazard overlays to identify hidden vulnerabilities, support stress testing, and build genuinely climate-resilient portfolios.

What happens when a bank’s biggest borrower is a real estate developer in a floodplain? Financial risk is shaped not only by market forces but by the physical environment. Rising sea levels, once a distant threat, now translate into credit risk, defaults, liquidity pressures, and mounting non-performing loans (NPLs). Climate shocks are no longer distant scenarios; they’re balance sheet events.”

This context gives rise to climate-resilient portfolios (CRP); the scaffolding of low-carbon finance, helping banks seize green opportunities while cushioning them against climate shocks. In simple terms, it’s about building loan portfolios that can weather the storm.

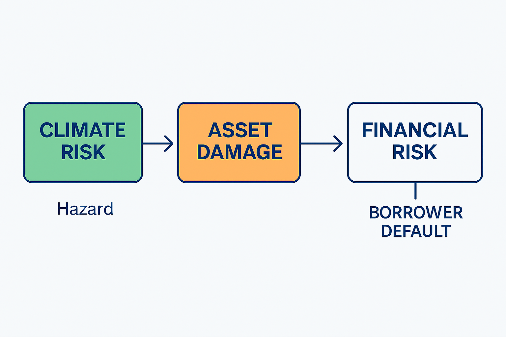

Climate risk takes two forms:

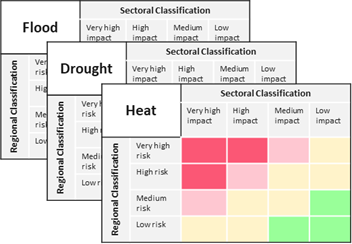

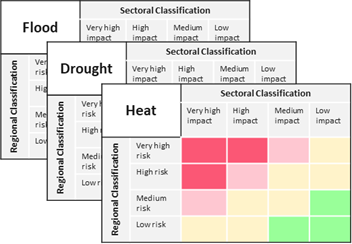

Regulators are turning up the heat. New NGFS short-term scenarios make climate risk assessment less a “nice-to-have” and more an operational requirement. Portfolio mapping provides banks with a clear picture of where they’re most exposed. It quantifies exposures, guides credit terms adjustments, supports portfolio diversification and adaptation, and turns climate risk from abstract into measurable metrics.

Reliable data is the Achilles’ heel, particularly for small and medium-sized enterprises (SMEs). SMEs often lack the resources to report their carbon footprints or provide precise geographical data, making it difficult to assess physical and transition risks. Without reliable data, institutions rely on assumptions, leading to mispricing of risk and missed opportunities for green financing.

Beyond data gaps lie deeper challenges: outdated datasets, lack of firm-level detail, and difficulty translating climate impacts into financial metrics. A carbon footprint alone tells only half the story; it says little about how ready a firm is to adapt. More holistic approaches integrate qualitative signals such as investment plans, patents in green technologies, and corporate climate strategies.

Another barrier is limited expertise in climate modelling and the lack of shared standards for factoring physical risk into credit models. Tools like FS Climate Risk 360 are starting to close this gap, merging hazard and financial data to make climate risk analysis more user-friendly.

Loan portfolio mapping acts like an X-ray for financial systems

It reveals hidden pockets of risk across regions and sectors, strengthens capital allocation, informs collateral valuation, and helps build resilience. Most importantly, it enables proactive management through portfolio diversification, adjusted insurance, and climate adaptation finance.

Mapping loan portfolios against climate hazards is the first step toward building climate-resilient portfolios. By overlaying hazard data, sector-specific vulnerabilities, and forward-looking scenarios, financial institutions can move from reactive risk avoidance to strategic foresight and climate-savvy investing. As climate shocks intensify, loan portfolio mapping must become part of banking DNA, not just a compliance exercise, but an innovation tool. It protects balance sheets while unlocking opportunities in adaptation finance. Ecological economics reminds us that finance does not exist in a vacuum; the financial system lives within the natural one. Understanding that connection is the key to long-term resilience, prudent risk management, and sustainable value creation. So, how prepared is your institution for climate-driven credit risk beyond disclosures, dashboards, and scenario narratives?