Climate change has a global impact in human lives relentlessly threatening the supply of clean air, safe drinking water, nutritious food and safe shelter. According to the WHO, between 2030 and 2050, climate change is expected to cause approximately 250 000 additional deaths per year from malnutrition, malaria, diarrhoea and heat stress alone.

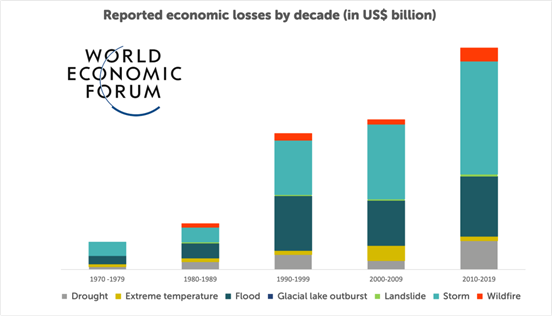

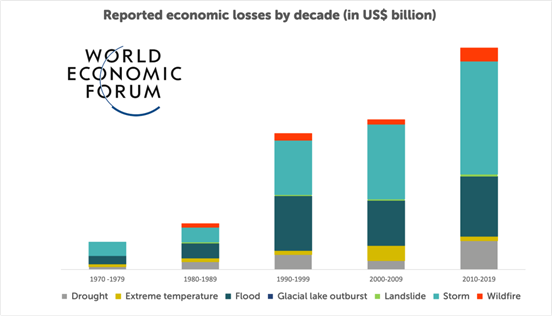

Moreover, the severe economic impact has been increasing steadily: climate change caused losses reaching $1.5 trillion in the last decade alone (2010-2019), and are expected to grow to a yearly $1.7 to $3.1 trillion by 2050.

According to UNSGSA, more than four out of five of the world’s unbanked adults (1 billion people), reside in the most climate-vulnerable countries. Therefore, climate change awareness needs to have a direct influence on financial inclusion efforts, both market-driven initiatives and also policymaking approaches, so the provision of inclusive financial services can bring much needed support for the most exposed groups of society that need to protect their livelihoods and assets.

The financially excluded segments of the population are, naturally, more vulnerable to any kind of adverse economic shock that may arise. Climate change affects all individuals worldwide, however poor households are disproportionally exposed to greater risks of local and global environmental change.

Climate change risks are dramatically experienced by people at the base of the pyramid who usually face geographic challenges and demographic pressures while living with lower levels of income and resources to access adaptation and mitigation measures. Frequent and extreme weather events, storms, floods, droughts, heatwaves, wildfire, natural disasters, crop failures and all climate change misfortunes are more likely to affect harder low-income rather than higher-income households. Furthermore, besides a long list of health issues, whenever food and commodities prices go up drastically after adverse weather conditions, the budget of low-income households takes a harsh blow.

Climate change also has seriously detrimental effects on firms, especially micro and small enterprises who already have limited options to raise capital, get loans and, overall, access much needed financial services. Such effects come in the form of rising operating and financing costs and having to face even more financial inclusion barriers.

Inclusive financial services, carefully designed considering all financial inclusion dimensions (usage, access and quality), can play a crucial role in helping the base of the pyramid to adapt to climate change. Digital financial services (DFS), in particular, can support vulnerable populations in several ways to foster their resilience to the impact of climate change. Inclusive financial services can empower communities and enable investments in climate resilience-enhancing tools, supplies, and greener production methods.

Traditionally, savings invested in livestock or crops are highly vulnerable to environmental disasters. Savings stored in cash are not only non-interest bearing but also a very risky method. Providers can develop digital savings products to offer more benefits to enhance climate change resilience and provide households with the opportunity to have access to their resources more safely, conveniently and timely to address shocks caused by climate change.

Digital microcredit takes advantage of customers data, such as cash flows or the trace of transactions, which can be very useful for faster and more accurate risk assessments which translates into a less expensive credit-granting process. Low-income families and MSMEs can make use of digital microcredit to better cope with natural disasters and to build a buffer to invest in adaptation solutions.

Microinsurance is another use case that benefits heavily from the digital approach. Transaction costs in microinsurance products can be significantly lowered through the use of digital platforms allowing insurance to become affordable for smallholder farmers and other vulnerable groups that need to address environmental threats. Additionally, by incorporating meteorological information and geospatial digital data, microinsurance providers can improve their products in an easier and more efficient way. Premium payments and insurance pay-outs can be made using mobile technology adding convenience to customers in rural areas.

Financial inclusion is a policy issue of extreme relevance to address climate change effects. Policymakers, regulators and supervisors can draft regulatory frameworks to ensure that digital financial inclusive products and services help increase the climate resilience of vulnerable and disadvantaged groups, rather than adding financial turmoil to the risks they are already exposed to. Digital financial inclusion can enhance climate change resilience with the support of policy frameworks that introduce regulatory enablers. Some of those enablers can be focused on digital payments, e-money (including non-bank e-money issuance) and all services that build on this infrastructure, the use of agents, risk-based customer due diligence and consumer protection. Even though the convenience of the digital approach itself can help reduce financial exclusion and vulnerability to climate risks, financial regulators must also remain aware of important and particular challenges in access, particularly those faced by women, ethnic minorities, the youth and displaced groups.

When developing actionable policies, regulators need to harness synergies between green finance and financial inclusion to improve the livelihood of low-income people and MSMEs, and simultaneously contribute to climate change adaptation and mitigation. To that extent, there are two broad types of policies that can be implemented: direct measures, i.e., cash transfers to affected populations, subsidies or guarantees to invest in resilience-enhancing activities or climate change mitigation technologies, and directed credit with green sectoral targets; and indirect measures, i.e., market-shaping policies, regulatory enablers of financial products and services, environmental and social risks management regulations, green risk weights incentives, capacity building initiatives, taxonomies (lists of sectors and activities that may be classified as green or sustainable), and consumer protection measures.

Finding solutions to address the impact of climate change in society and understanding the role of the financial system integrating sustainability approaches are tough challenges that require the best possible high-level education. The Frankfurt School’s upcoming Summer Academy 2024 and its online certificate programmes aim to drive professionals to elevate their potential and to achieve their goals in a modern and competitive environment immerse in social and economic hurdles.