When German-born British economist E. F. Schumacher published his book “Small Is Beautiful” in 1973, he proposed an alternative to the mainstream economic principle of “bigger is better”. Schumacher was an early proponent of sustainable development, demanding that people and the planet should matter more than mere profits.

Agriculture plays a key role in global and local sustainable development. It is not an exaggeration to say: Farming is everyone’s business! Just think about the following mind-blowing facts:

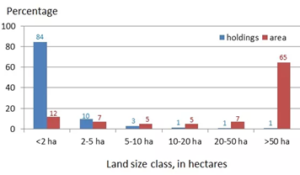

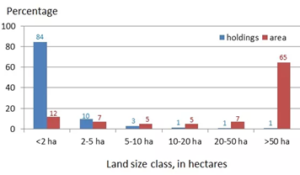

Figure 1: Distribution of the world’s farms and farmland area by land size class.

Source: CGAP (https://www.cgap.org/blog/global-distribution-of-smallholder-and-family-farms).

If we consider sustainability in all its dimensions – social, economic and environmental – we need to focus on the world’s half-billion smallholder farms.

About two-thirds of the world’s poor are farmers. The good news first: growth in the agricultural sector is two to four times more effective in raising incomes among the poorest compared to other sectors. The bad news: only a quarter of the estimated USD 200 billion financing needs of farmers are currently being met by the financial sector. Put more positively: providing finance to smallholders is the biggest opportunity for scale and impact in financial inclusion today.[1]

Most smallholder farmers are poor and suffer seasonal food shortages. Yet, their livelihoods are increasingly being threatened by the effects of climate change, degraded ecosystems, pollution and natural resource depletion. Think of droughts, floods, storms, farmland turning into deserts and water polluted by agrochemicals; on top of that, armed conflicts, land grabbing and forced displacements of farmers that have no official land ownership titles. There are countless threats to smallholder farmers’ livelihoods, which can be tackled by shifting to sustainable farming methods.

The typical smallholder farm is managed in a traditional way, that is, mixed farming, to produce food for the family and sell any surplus on the local market. Even when smallholder farmers cultivate cash crops, like coffee or cotton, they use less agrochemicals than larger farms. With the help of simple investments, these small farms can be made more productive and, at the same time, more environmentally sustainable.

For example, trees planted on farms as part of an agroforestry system generate additional income for the farmer while making the farm more climate-resilient (protection from heat and storms), capturing carbon (in the timber and soil) and fostering biodiversity by creating habitats for insects and birds. In fact, there are many such simple, sustainable farming methods that can have positive social, economic and environmental impacts at the same time.

So, why are small farmers not putting all these great ideas into practice? Simple answer: they lack the funds. This is where financial institutions come into play.

The main reasons why most banks and insurers shy away from serving smallholder farmers are the perceived risks of agriculture and the relatively high transaction costs of serving farmers in remote areas. Fortunately, there are answers to these problems.

Successful providers of smallholder finance, such as rural microfinance institutions and agricultural development banks, have found ways to tackle the risk and cost challenges. For example, they cooperate with farmer groups, cooperatives, exporters or food processors to channel loans and repayments through their books. Funds are invested in sustainable farming practices, including agroforestry, certified organic farming, the production of biofuels, rainwater harvesting and drip irrigation, to name just a few examples.

Insurance companies have successfully experimented with index insurance, for instance, to cover farmers against droughts. And there are many innovations in the field of digital finance, such as the use of mobile phones to transfer payments from buyers to farmers, linked to technical farm advice via text messages.

Employees of financial institutions require new technical and managerial skills to tackle the various challenges related to the transformation of agriculture. This is one of the focal areas of the Summer Academy 2023 offered by Frankfurt School from 3 to 7 July in Frankfurt am Main, Germany. Other themes of this year’s Summer Academy are Risk Management, Digital and Inclusive Finance, Sustainable Finance and Housing Finance.

Take a look at the Summer Academy website to find out more.

[1] cf. https://www.cgap.org/blog/global-distribution-of-smallholder-and-family-farms