On November 29, the student initiative FS Jumpstart had the honor to host Heiko Verhaag and Cihan Duran from S&P Global Ratings at the new campus of Frankfurt School. Both guest speakers work in the financial institutions team of S&P in Frankfurt and introduced us to their work as a Rating Analysts.

After a warm welcome to the event given by FS Jumpstart we immersed ourselves into a very insightful and hands-on presentation about ‘European Bank Ratings’.

Heiko first introduced us to S&P Global Ratings and gave us an overview of the company itself. He then explained what ratings are and what they are not, what different rating categories there are, and what a rating process looks like. Here, we focused on the topic of independence of rating agencies. As many people tend to assume that ratings are biased and that rating agencies are paid for good ratings, we learned that there is no basis for this assumption. Heiko explained that there is a so-called ‘Chinese wall’ between the sales force that negotiates contracts with the institutions that want to be rated and the analysts that finally conduct the rating. The analysts are given the task to conduct a rating. They do not have any contact with the sales personnel or get information about the sales contracts. If sales personnel and rating analysts want to communicate, they need to involve compliance. Further, a rating committee is installed to review the rating proposed by the analyst before the rating then eventually is finalized and issued. With this procedure, it is guaranteed that the ratings issued are unbiased. Heiko further showed to us the historical default risk development by rating category over a time frame of 20 years.

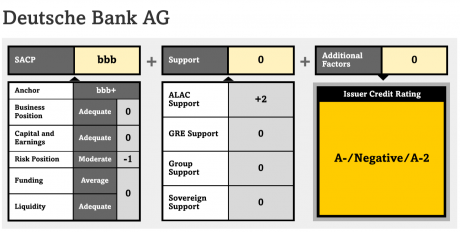

Thereafter, Cihan presented a case study in which we came to more thoroughly understand how a rating is conducted by taking Deutsche Bank as an example. Cihan explained to us the different steps that must be undertaken to ultimately arrive at a rating. The first step is the Banking Industry Country Risk Assessment (BICRA), which is a macro analysis of economic and industry risk that Deutsche Bank faces. This provides the “anchor” for the rating, in Deutsche Bank’s case BBB+. From this anchor, we then continued with the evaluation of bank-specific characteristics such as: business position, capital and earnings, risk position, as well as funding and liquidity. Finally, we assessed the likelihood of government support and the availability of additional loss absorbing capital for the bank. Having BICRA as a base, then the outcomes of each risk assessment (e.g. +1 notch, 0 notch) were applied leading us to a final rating for Deutsche Bank of A-.

Source: S&P Global Ratings “RatingsDirect” Deutsche Bank AG (November 15, 2017)

After an interesting Q&A session, we ended the evening with a small and informal get-together with beer and snacks.

We strongly appreciate that our guest speakers have taken the time to come to Frankfurt School and to introduce us to the rating process – thank you very much for this insightful presentation! We have learned a lot and it was a great opportunity for our fellow students to immerse themselves into such an interesting topic.

Further, we want to thank FS Career Services and FS Student Life for their support and enabling us to host this Event.