A new supervisory regime for investment firms is coming into force at the end of June 2021. This poses a regulatory challenge for financial services providers. Financial services institutions that qualify as investment firms will be obliged to comply with Germany’s new Securities Trading Act (WpIG) and the EU’s new Investment Firm Regulation (IFR – (EU) 2019/2033)). Previously, all investment firms were regulated under the German Banking Act (KWG) and the CRR.

Any company that, as part of its regular business or established business activities, provides investment services or a combination of investment services with ancillary or related services, is deemed to be an investment firm.

According to the definitions in the Marketing of Financial Instruments Directive (MiFID), investment services include, among other things, financial brokerage, the administration of financial portfolios, contract brokerage, and investment advice.

Two European laws are the starting point for the new regulations

For the first time, the EU’s new Investment Firm Regulation (IFR – (EU) 2019/2033)) and Investment Firm Directive (IFD – (EU) 2019/2034) have created a dedicated regulatory framework for all businesses that provide investment services as defined in MiFID. The aim of both laws is to create a separate prudential supervisory regime for investment firms.

The intention is to establish a simpler, clearer and more user-friendly legal framework for small and medium-sized investment firms in particular.

Both the IFR and WpIG distinguish between three classes of investment firm:

Small investment firms (class 3)

These are small, non-interconnected investment firms with, in particular, total assets of less than EUR 100 million. They also meet other IFR criteria related to, for example, the volume of client assets managed by their investment advisory service (assets under management) or the amount of client money held.

Large investment firms (class 1)

Large investment firms include investment firms with consolidated assets of EUR 15 billion or more, engaged in own-account dealing and/or underwriting services. If total assets exceed EUR 30 billion, the firm should be classified as a credit institution within the meaning of the CRR.

In the vast majority of cases, IFR and WpIG regulations do not apply to large investment firms. Due to the risks associated with their size, they are treated as credit institutions under European law and will continue to be subject to CRR and KWG regulations.

Medium-sized investment firms (class 2)

Medium-sized investment firms are those which are not classified as either small or large investment firms.

In proportion to an investment firm’s size and impact on financial stability, the WpIG essentially sets down:

The IFR, which was adopted on 27 November 2019, represents a completely new set of regulations governing requirements in the following areas:

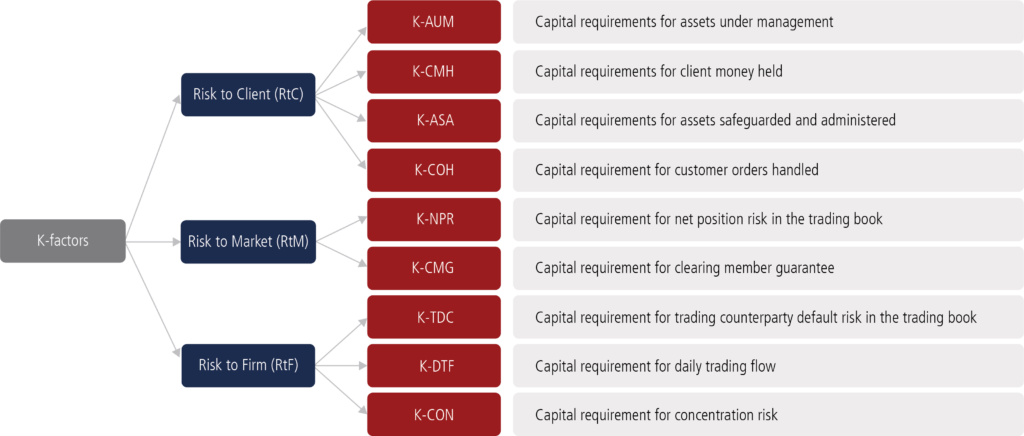

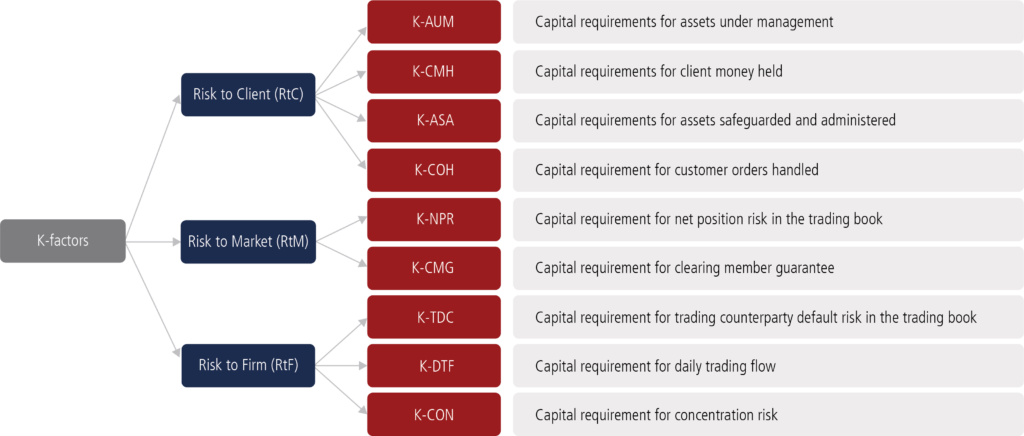

The new regulations diverge significantly from existing KWG and CRR regulations. In particular, the IFR provisions for calculating minimum capital requirements on the basis of so-called K-factors, which are especially important for medium-sized investment firms, are completely new:

IFR specifies separate calculation methods for each K-factor, which investment firms are required to implement. The newly designed reporting system for investment firms includes more than 20 report forms, most of which are used to report K-factors and concentration risks. The new regulations will apply as from 26 June 2021, the first reporting date being 30 June 2021. Investment firms must now ensure that they are correctly classified in one of the three classes defined by the new regulations, and that they use the intervening period to implement the new requirements in good time, i.e. by June 2021. By taking Frankfurt School’s “Reporting Specialist for Investment Firms” (Meldewesenspezialist für Wertpapierinstitute) course, you can acquire the knowledge you need to be able to complete the new report forms in compliance with the new regulations.