In April of last year, the European Banking Authority (EBA) published a new guideline on the resubmission of historical data under the EBA reporting regulations (EBA/GL/2024/04).1 This primarily concerns Pillar I reporting data, but also data that is regularly submitted to the supervisory authority. The guideline explains how to correct this data.

Institutions are currently required to promptly correct incorrect data points in reports (Art. 3(5) EBA/GL/2021/451). However, there have been different interpretations of this imprecise rule. For example, it is unclear whether and to what extent historical errors must be corrected. Inconsistent treatment of errors significantly complicates the work of the supervisory authorities. Therefore, there is now a provision that specifies when and how errors or inaccuracies should be corrected.

The main new feature of the guideline is the definition of a time interval that determines which historical reporting data must be submitted to the corrected current report. This period has been specified for each reporting frequency:

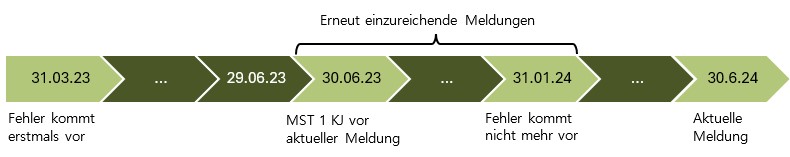

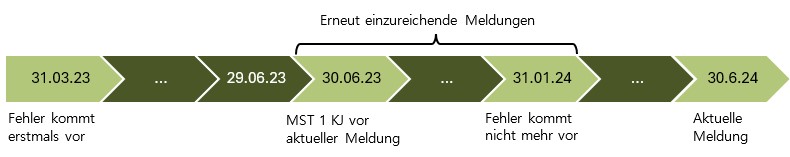

Historical data must only be corrected if they are not older than one year. It is sufficient to correct errors up to the date from which they no longer occur. It is recommended to consult with the relevant supervisory authority in this regard. Experience shows that the correction of historical reporting data is very time-consuming for institutions and the exact scope of the data to be submitted should be clearly defined.

For example: an error is discovered in the report for 07/2024. All historical reports up to 12/2023 must be resubmitted together with the corrected version of the current report (07/2024). The inclusion of the 12/23 report extends the period by one month.

The guidelines apply equally to all institutions, regardless of size. As smaller institutions generally have less to report, it should also be appropriate for these institutions to consistently improve their data.

It is not uncommon for data points to appear in various reports. For example, if there is an error in a monthly report and this error also affects reports with a different frequency or content, these data must be corrected and submitted for the same period as the original monthly report.

The supervisory authority may require the reporting institution to explain and justify the error and its correction. In addition, institutions may be required to resubmit past reports that go beyond the previously defined timeframe. Accordingly, institutions need to develop an infrastructure that can also collect and process data points from the more distant past.

When the data taxonomy is updated, it may be necessary to restructure and resubmit historical data according to an old data point model. Institutions will need to develop processes for this.

With the guideline, the EBA has increased the tolerance range for monetary data from €1,000 to €10,000. Errors below this threshold do not need to be corrected. Another exception applies to potential improvements in the reporting regulations. Publication of individual EBA Q&As may make it necessary to correct the data, although these do not need to be improved. Master data is not handled according to the provisions at hand.

Processes must be developed in line with the guideline in order to comply with the new rules. The quality of data storage will have to be drastically improved to meet the requirements. The EBA is aware that this represents a significant additional burden for financial institutions. However, the supervisory authority felt compelled to clarify this matter, as the current rule was not being interpreted consistently. The guideline creates incentives for accurate data storage, which is an important basis for the work of the authorities. The restriction to reports that are not older than one year and the widening of the tolerance range show that the cost to institutions has been taken into account.

Interested in enhancing your expertise in regulatory reporting? Discover our course offered in English: Risk Manager & Regulatory Reporting Specialist.