The environment in which most companies find themselves working today is already very complex, and it is likely that current crises (the Covid-19 pandemic, the European energy crisis) will make it even more complex. Furthermore, customer preferences with respect to products and services are more changeable than ever before. To stay competitive, companies must develop new products and services, and in certain cases new business models. This is why many companies are now looking to decentralise their business units, so they can respond faster and more flexibly to new changes in their business environments and circumstances, and to customer demands. These changes are also impacting controlling functions as the following questions become increasingly salient:

Preliminary answers to these questions may be found in the results of a study entitled Organization of Decentralized Controlling Units conducted by the Centre for Performance Management & Controlling at Frankfurt School of Finance & Management in collaboration with eight European partners. A total of 246 companies and/or their decentralised business units took part in the online survey. Below, we examine the impact of today’s complex business environment on decentralised controlling units, and explore the possible impact of decisions to decentralise strategic (as opposed to purely operational) activities on the effectiveness of controlling.

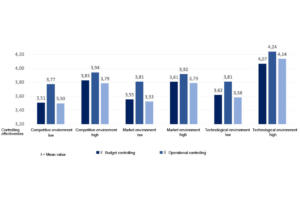

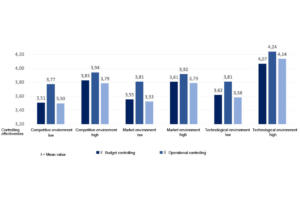

Companies were asked questions about several dimensions of their complex business environment, including their competitive environment, market environment and technological environment. They were asked to rank each dimension’s complexity on a Likert scale ranging from 1 (= not complex) to 5 (= highly complex). If we then divide the companies into two groups based on the degree of complexity across all dimensions (competitive, market and technological environments) using the median split, our results show that companies exposed to a highly complex competitive, market and technological environment show more effective or significantly more effective controlling across their budgetary, operational and strategic controlling activities (cf. Fig. 1). It appears that companies operating in complex or highly complex environments must set up their controlling functions to be particularly effective in order to remain competitive over the long term. If companies do not offset the complexity of their business environment by putting effective controlling in place, it is highly likely that they will be forced to abandon the market.

Fig. 1: Effectiveness of controlling broken down by complexity of business environment.

To gauge the impact of the degree of decentralisation of a controlling function on the latter’s effectiveness, companies were asked to answer various questions on the decentralisation of strategic and operational activities. Strategic activities included the establishment of new lines of business; the development of new products and services; decision-making on business-building investments, and the financing of projects/programmes. Operational activities included the selection of customers and negotiation of contracts with customers; the selection and commissioning of suppliers; the prioritisation of business activities; the hiring and firing of employees within the decentralised unit, and the structuring of processes and workflows within the decentralised unit. Once again, companies were asked to rank the degree of decentralisation on a Likert scale ranging from 1 (= corporate head office retains all decision-making authority) and 5 (= decentralised unit is given all decision-making authority). If we again divide the companies into two groups based on the degree of decentralisation (minimally decentralised vs highly decentralised) using the median split, it becomes clear that companies which give their decentralised business units a high level of autonomy for their strategic activities show significantly more effective controlling. If, on the other hand, we take a closer look at the decentralisation of operational activities, it becomes clear that decentralisation has minimal impact on the effectiveness of the controlling function. On the one hand, this confirms that there is indeed a trend towards decentralisation that aims to bring decentralised units as close to their target markets and customers as possible so they can respond to changes as swiftly as possible. On the other hand, it also appears that merely giving decentralised units operational autonomy is not, in itself, enough to enable them to manage themselves successfully. Above all, decentralised units and their local controlling functions need strategic autonomy in order to survive and succeed in today’s complex business environment.

From the above results, we can draw the following conclusions for practical recommendations:

Only by giving a decentralised business unit’s controlling function the greatest possible strategic autonomy can a company add real value and boost the controlling function’s effectiveness. For this reason, companies should avoid setting up decentralised units that have only been granted operational decision-making authority, because unless these units are empowered to make strategic decisions, they will not benefit from their decentralised situation. The findings of all studies conducted by the Centre for Performance Management & Controlling are incorporated into our Executive Education offerings. Thus our Certified Financial Expert certification course, for example, addresses the pressing issues discussed above.

Authors

Prof. Dr. Ronald Gleich

Professor of Management Practice & Control

Since August 2020, Ronald Gleich has been a Professor of Management Practice and Control at Frankfurt School. His research focuses on current and practically relevant issues in controlling, innovation management and performance measurement.

Prof. Dr. Uwe Kowatz

Research Assistant in Empirical Social Research

Prof. Dr. Uwe Kowatz is a research assistant and expert in empirical social research at the Centre for Performance Management & Controlling at Frankfurt School of Finance & Management.

Marius Knierim

Head of Value at Hays AG

Marius Knierim is the Head of Value Creation at Hays and deals with various topics related to corporate governance and the transformation of the finance function.

Nils Gimpl

Research Assistant & Project Assistant

Nils Gimpl is a research assistant at the Centre for Performance Management & Controlling at Frankfurt School and a doctoral student at Saarland University. He is interested in topics related to the digitalisation of controlling, data analytics and strategic (personnel) planning.

Bibliography:

Horváth, P., Gleich, R., & Seiter, M. (2020). Controlling. Munich: Vahlen.

Gleich, R., & Temmel, P. (2007). Organisation des Controlling – Impulse aus der Wissenschaft [Organisation of controlling – new ideas based on research]. Organisation des Controlling. Grundlagen, Praxisbeispiele und Perspektiven, Freiburg: Haufe, 13‐32.