Small and medium-sized companies (SMEs) are increasingly expected to report their environmental, social and governance (ESG) performance. But do banks reward good ESG performance with a lower interest rate? The short answer is “no, not really”. But bad performance might be punished in the future.

In a recent research project, I conducted expert interviews with one-third of German banks (measured by total assets). The key findings are described in the following.

ESG aspects are gaining importance, driven by the adaption of the European (regulatory) framework. The European Central Bank, for instance, is encouraging banks to include climate risks in their lending activities: “As a supervisory authority, it is our duty to contribute to the safety and soundness of the banking sector by ensuring the industry has made adequate preparations to manage climate-related risk”. According to the EU Sustainable Finance Action Plan, capital flows are to be redirected towards sustainable activities, i.e., by banks pricing in ESG risks. Furthermore, Social and Governance aspects are becoming increasingly regulated, e.g., through the German “Lieferkettensorgfaltspflichtengesetz” (LkSG). In the context of reporting and disclosure, the Corporate Sustainability Reporting Directive (CSRD), among others, increasingly obliges companies to disclose their sustainability strategy and metrics. These obligations are now also becoming relevant for a larger number of SMEs (directly and indirectly), which highly depend on banks’ financing. Consequently, the question of how sustainability affects the relationship between companies and their bank and their financing costs is currently of high relevance, given the costs associated with the disclosure and measurement of the criteria.

All interviewed banks emphasise that ESG aspects are highly relevant in their strategy and lending activities. Several banks support their customers in the sustainability transformation process with the help of dedicated ESG advisory teams. Furthermore, all banks apply certain exclusion criteria in their lending processes. However, only soft, qualitative ESG aspects have been assessed so far in the standard lending process. Banks are currently developing sustainable products that meet recognised market standards (e.g., those of the Loan Market Association).

Within the standard lending process, banks face the tension between data availability and regulatory requirements. While large banks have started collecting data and integrating qualitative measures, smaller banks (e.g., smaller savings banks and cooperative banks) currently aim to create transparency internally. Widely used industry standards among companies, such as the ISO 14001 environmental certification, are of minor importance for the relationship between banks and companies. Therefore, industry standards will have to be established to demonstrate the ESG performance of an SME to the bank.

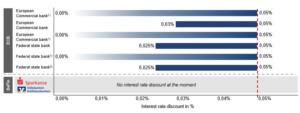

Sustainable companies are expected to have improved access to financing; however, ESG aspects are currently not adequately considered in the interest rate (see Figure 1). This is among other reasons since ESG aspects are limitedly reflected in the credit rating due to regulatory requirements, a lack of available data and technical constraints. Furthermore, banks currently have no significant refinancing advantages via capital markets. As part of a strategically driven orientation towards sustainability, large banks offer particularly sustainable companies tailored ESG loans, enabling these companies to achieve non-material interest rate discounts of around 2.5 to 5.0 basis points (i.e., only 0.025 – 0.05%) per year. Thus, the mere reduction of borrowing costs through ESG disclosure does not represent an economically relevant incentive for SMEs to increasingly address ESG reporting and disclosure.

Figure 1: Interest rate discounts for bank loans due to positive ESG disclosure

Notes: 1) Gradient fill for two European Commercial banks and a federal state bank indicates that no minimum was given during the interviews; 2) A federal state bank stated that in one exceptional case, up to 10 bps had even been achieved.

ESG-disclosure requirements will become stricter for companies, and auditing of these criteria will be extended. Furthermore, it is intended that banks will have to bear higher minimum capital requirements for granting non-sustainable loans. This could result in non-sustainable companies either being denied funding or being offered funding at significantly more expensive conditions instead.

If you are interested in Sustainability and Corporate Performance, check out Frankfurt School’s new certificate course: Corporate Sustainability Controlling, to learn more.

This article is based on the more comprehensive article: Englert, Mario, Glang, Paul, Mahlendorf, Matthias D., “Was bringts? Der Effekt einer positiven ESG-Darstellung bei der klassischen Bankfinanzierung”, in Der Betrieb, (forthcoming).