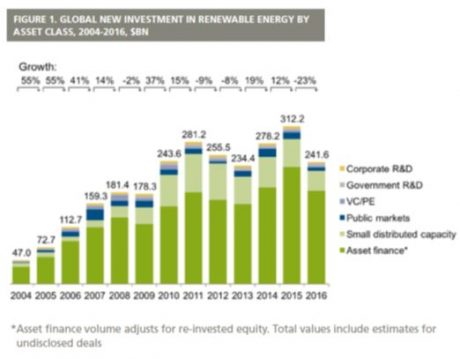

The price of renewable energy has continued to fall. Our annual report “Global Trends in Renewable Energy Investment”, released by the Frankfurt School – UNEP Collaborating Centre for Climate and Sustainable Energy Finance shows record-level added power production capacity based on renewables (138.5 gigawatts, about 9 percent more than last year). However, this came at a cost 23 percent lower than last year’s total global investment: Total investment in renewables in 2016 was around US$ 242 billion. To get a feeling for the order of magnitude in the electricity sector: Investment in power production based on renewables worldwide was twice as large as investment in coal and gas fired power stations combined. In other words: in the electricity sector investment in fossil fuels is starting to play a minor role. Opportunities are elsewhere.

A somewhat unusual picture emerges from looking at the different world regions: In China – although it is still by far the largest market in terms of renewables investment, the dollar volume fell by about a third as compared to last year. In the US, investment was down about 10 percent. Europe, however remained at last year’s level, data even suggest small increase by 3 percent. Why is this?

Of course in all regions the falling costs put pressure on investment volumes as the same capacity comes at lower costs. In China, however, there is more to this: Growth in 2016 was not quite as expected. That was reflected in lower than expected electricity demand growth. China also ended a feed-in-tariff regime which also contributed to reduce investment.

The reasons for falling investment in the US are completely different: Investment in power plants based on renewables remained almost flat, smaller – typically rooftop – solar systems increased by about a third as it is increasingly attractive for individual households. A big drop comes from so-called public markets investment falling more than 80 percent to about US$ 1.3 billion. Behind this is strong public market investment in the past that did not materialize in 2016: Share prices of “yieldcos” – stocks that represent a portfolio of operating-stage renewable energy projects – did not raise a lot of new equity after their share prices collapsed and the way the yieldco-concept was implemented in some cases was questioned.

Investment drivers for Europe are different again. Perhaps a bit more straight forward: Investment in solar photovoltaic and on-shore wind was falling in many large markets (Germany, UK), but from a larger European perspective this was compensated by a strong increase of investment in off-shore wind by more than 50 percent. In Germany alone (despite total investment falling more than 10 percent) three off-shore wind farms contributed about US$ 5 billion to asset investment.

Looking at the global picture, the general impression “more for less” might be good, but it is not enough: One and a half years ago, about 200 countries agreed in Paris to reduce global emissions to basically zero in the second half of the century. What we observe in terms of global investment is a good start, but current investment levels both in renewables as well as in fossil fuel based power production capacity are far from consistent with what practically all governments have agreed to. Renewables investment needs to increase while coal based power production needs to be ramped down drastically. This will be more difficult in countries where modern and long-lived coal capacities are still added.

Extensive detail about data and background are provided in the report jointly released by the FS-UNEP Collaborating Centre, UN-Environment and Bloomberg New Energy Finance. There you will also find the corresponding press releases in English, French, Spanish, Arabic, Chinese, Russian and German.

Some voices of media platforms include BBC News, the Washington Post or the New Scientist.